From 10 December 2021, the annual cap will be removed for all families who get CCS.

From 7 March 2022, families with more than one child in care will get a higher subsidy.

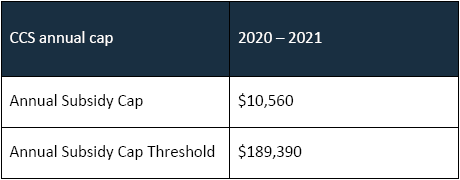

Annual cap

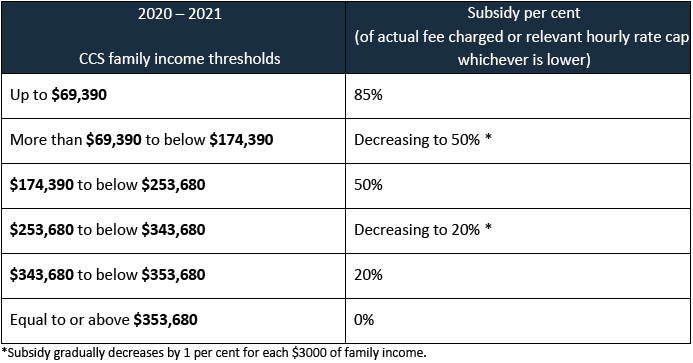

Families earning more than $190,015 (2021–22 terms) have an annual subsidy cap of $10,655 per child each financial year.

From 10 December 2021, this annual cap will be removed for all families who get CCS.

Families with more than one child in care

From 7 March 2022, families with children aged five or under in care will get a higher subsidy for their second child and younger children.

Who will be eligible?

Families may be eligible if they:

- earn less than $354,305

- have more than one child aged five or under in child care.

Who gets the higher subsidy?

Services Australia will work out which children get the higher subsidy by:

- assessing all children in the family unit

- identifying the standard rate child

- identifying the higher rate children.

The standard rate child will get the standard CCS subsidy. Younger children will get a higher subsidy.

The standard rate child is the eldest child in the family unit aged five or under who is eligible for CCS and attending care.

How much do higher rate children get?

Eligible higher rate children will receive a 30% higher subsidy, up to a maximum 95%.

Children eligible for the higher CCS rate will have the increase automatically included in their CCS percentage reported to services.

Additional Child Care Subsidy (ACCS)

Children who are entitled to both the higher CCS rate and Additional Child Care Subsidy (ACCS) will be paid the ACCS rate.

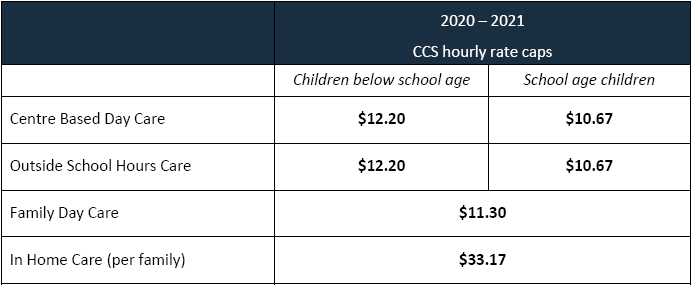

In Home Care

Sessions of In Home Care do not attract the higher subsidy for younger children. This is because In Home Care is subsidised on a family rather than per child basis.

However, children aged five or under in In Home Care are included in the family unit when determining the standard rate child.

A family with their standard rate child in In Home Care will get the higher subsidy for younger children who attend care.

What do families need to do?

Families already getting CCS don’t need to do anything. Services Australia will automatically increase the CCS for eligible second and younger children.

Families will be eligible for the higher rate from 7 March 2022.

For families new to CCS, a child must receive a session of care before they can be considered the standard rate child.

All CCS-eligible children aged five or under are counted in a family unit when determining the standard rate child, and the higher rate child/children.

For families with children born on the same date, Services Australia will automatically determine which child is the standard rate and apply the higher rate to other children.